All Categories

Featured

If you're mosting likely to use a small-cap index like the Russell 2000, you might wish to stop briefly and think about why a great index fund company, like Vanguard, does not have any funds that follow it. The reason is since it's a lousy index. Not to state that changing your whole plan from one index to one more is hardly what I would certainly call "rebalancing - universal life problems." Cash money worth life insurance policy isn't an eye-catching property class.

I haven't also attended to the straw male below yet, and that is the reality that it is reasonably uncommon that you in fact need to pay either taxes or substantial payments to rebalance anyhow. I never ever have. A lot of intelligent financiers rebalance as much as possible in their tax-protected accounts. If that isn't rather adequate, early collectors can rebalance totally utilizing brand-new contributions.

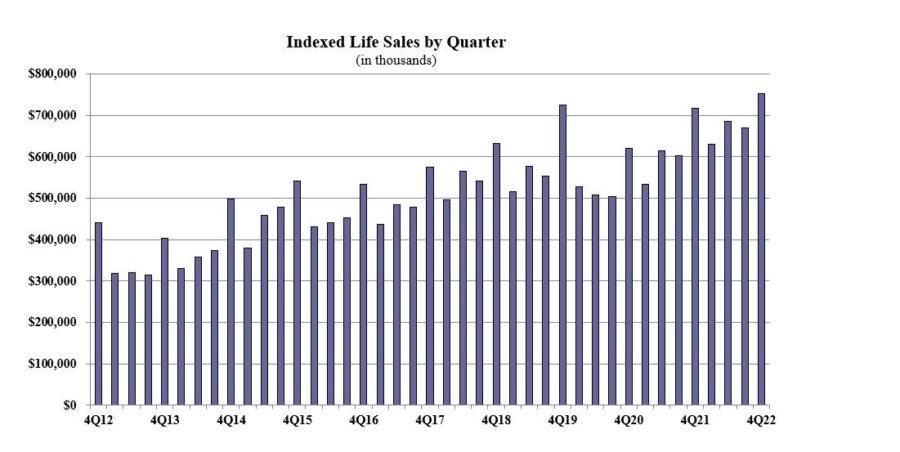

Insurance Indexing

And of course, nobody must be buying crammed common funds, ever. It's actually too negative that IULs do not function.

Latest Posts

Index Universal Life Insurance Reviews

Adjustable Life Plan

New York Life Universal Life Insurance